inheritance tax calculator florida

Even if no tax is due a return may still be required to be filed. The estate tax in Florida is calculated based on the fair market value of the estate assets.

Tennessee Retirement Tax Friendliness Smartasset Com Federal Income Tax Income Tax Return Inheritance Tax

There is no federal inheritance tax but there is a federal estate tax.

. Inheritance tax paid on what you leave behind to your heirs and they could pay as much as 40 tax on what they inherit. Florida residents are fortunate in that Florida does not impose an estate tax or an inheritance tax. You would receive 950000.

In this situation if the foreign person decedent also had 3 million of US. If the value of the assets being transferred is higher than the federal estate tax exemption which is 117 million for singles for tax year 2021 and 234 million for married couples the property can be subject to federal estate tax. Then you are left with the 40 federal estate tax on the residuary estate of 2500000.

Enter your financial details to calculate your taxes Add Pension You will pay 0 of Florida state taxes on your pre-tax income of 40000 Your Tax Breakdown Federal 1731. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. Charities exempt up to 500The tax rate on others ranges from 5 to 15 of inheritance.

40 of 2500000 1000000. Estate tax of 10 percent to 16 percent on estates above 1 million. For the estate tax a Florida resident or for that matter any United States citizen or resident alien may leave an estate with a value of up to 5340000 free of US estate tax or inheritance tax.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. Are vehicles taxed in Florida. The good news is Florida does not have a separate state inheritance tax.

Inheritance Tax Calculator Our Inheritance Tax Calculator is designed to work out your potential inheritance tax IHT liability. Inheritance tax of up to 15 percent. To the extent its assets exceed the 1118 million exemption as of 2018 an estate is taxed at a marginal rate of up to 40.

Inheritances that fall below these exemption amounts arent subject to the tax. The first 1000000 has a base tax of 345800. In Pennsylvania for instance the inheritance tax may apply to you even if you live out of state as long as the deceased lived in the state.

2021 taxiowagov 60-062 01032022 Pursuant to Iowa Code chapter 450 the tax rates are as follows. Florida also has no gift tax. Just because Florida lacks an estate or inheritance tax doesnt mean that there arent other tax filings that an.

Ad Inheritance Guidance is Just One of the Benefits of Wealth Planning. There is no inheritance tax in Florida but other states inheritance taxes may apply to you. The estate would pay 50000 5 in estate taxes.

Updated for the 2021-22 tax year. Inheritance tax of up to 16 percent. Complete the questions below and well work out your potential Inheritance Tax bill and how much you could save by using a Trust.

Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. Immediate family members. Estimate the value of your estate and how much inheritance tax may be due when you die.

If the net estate of the decedent found on line 5 of IA 706 is less than 25000 the tax is zero. Situs then any amount over 60000 may be taxed at 40. Tell us about your relationship status.

The tax rate varies depending on the relationship of the heir to the decedent. As long as your Florida estate tax payment exceeds the amount of your other states tax you wont be penalized. This is a far cry from the exemption amount for US persons which is roughly 112 million.

There are a few states that levy taxes on the estate of the deceased generally referred to as the inheritance tax or the death tax. Florida sales tax is due at the rate of six percent on the 20000 sales price of the vehicleNo discretionary sales surtax is due. Estate tax of 08 percent to 16 percent on estates above 16 million.

If you have 5 million or less congratulations. You would pay 95000 10 in inheritance taxes. Even further heirs and beneficiaries in Florida do not pay income tax on any monies received from an estate because inherited property does not count as.

It is sometimes referred to as a death tax Although states may impose their own estate taxes in the United States this calculator only estimates federal estate taxes Click here to check state-specific laws. 1000000 345800 1345800. Complete the information in the calculator to see how much your family could be liable to pay in IHT tax to HMRC when you die.

Estate tax of 306 percent to 16 percent for estates above 59 million. If your estate is worth 15560000. This means that if your assets appreciate in value you wont have to worry about paying taxes on those values.

You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000. Thats right there is no estate tax for the vast majority of US citizens. Immediate family members spouses parents children are exempt.

In 2021 federal estate tax generally applies to assets over 117 million. From Fisher Investments 40 years managing money and helping thousands of families. See IA 706 instructions.

As mentioned above the State of Florida doesnt have a death tax but qualifying Florida estates are still responsible for the federal estate tax there is no federal inheritance tax. Iowa Inheritance Tax Rates. Iowa for instance doesnt impose an inheritance tax on beneficiaries of estates valued at 25000 or less.

Youll need to check the laws of the state where the person you are inheriting from lived. The Federal government imposes an estate tax which begins at a whopping 40this would wipe out much of the inheritance. An estate tax is a tax imposed on the total value of a persons estate at the time of their death.

There is no inheritance tax in Florida but other states inheritance taxes may apply to you. Sale of 20000 motor vehicle to a resident of another state where the sales tax rate on motor vehicles is two percent.

Property Tax Calculator Casaplorer

Determining Illinois Estate Tax Rate Is Surprisingly Difficult

Florida Income Tax Calculator Smartasset

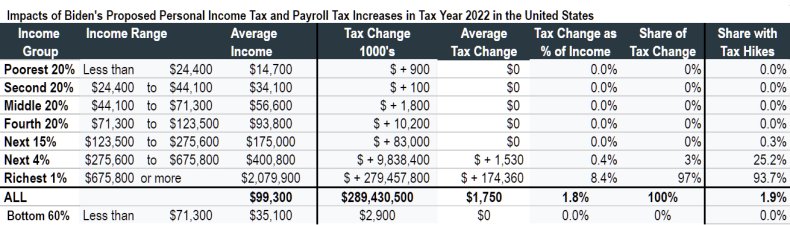

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

What Are Marriage Penalties And Bonuses Tax Policy Center

Va Loan Calculator For Florida Mortgage Loan Calculator Va Loan Calculator Va Loan

Mathing Out Estate Tax Planning Strategies

How To Calculate Inheritance Tax 12 Steps With Pictures

Free Estate Size Worksheet And Tax Calculator Married Free To Print Save Download

Capital Gains Tax Calculator 2022 Casaplorer

Nyc Mansion Tax Calculator For Buyers Interactive Hauseit

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Nyc Mortgage Recording Tax Calculator Interactive Hauseit

Become Familiar With The Complex And Ardous Procedure Of The Estate Arranging Naples Florida Revocable Living Trust Naples Florida Grantor Trust